franklin county ohio sales tax on cars

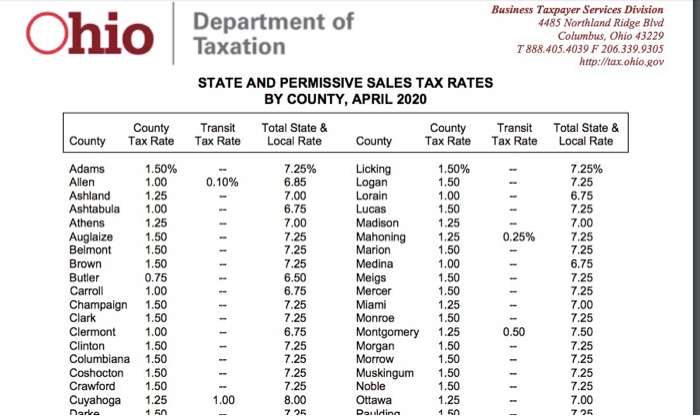

You may obtain county sales tax rates through the Ohio Department of Taxation. Sales Tax On Cars In Franklin County Ohio.

Franklin County Courthouse 1887 1974 Wikipedia

The minimum combined 2022 sales tax rate for Franklin County Ohio is.

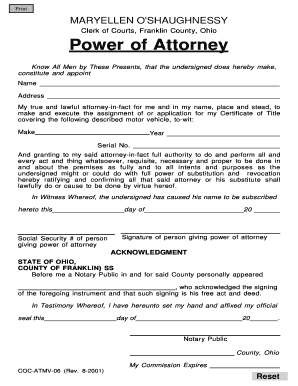

. Additional evidence may be required based on unique titling situations. What is the sales tax rate in Franklin County. What is the sales tax on cars in Franklin County Ohio.

Have your car inspected at a new or used car dealership or any Deputy Registrar. This is the total of state county and city sales tax rates. This is the total of state and county sales tax rates.

The latest sales tax rate for franklin oh. 2022 Ohio Sales Tax By County Ohio has 1424. Or visit our Ohio sales tax calculator to lookup local rates by zip code.

Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange. Some cities and local governments in Franklin County collect. We accept cash check or credit card payments with a 3 fee.

17TH FLOOR COLUMBUS. Franklin county ohio sales tax on cars. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

The properties in community reinvestment areas in franklin county had an. Some dealerships may also charge a 199 dollar documentary. The Franklin County Treasurers Office wants to make sure you are receiving all reductions savings and assistance to which you may be entitled.

The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and. The County sales tax rate is. The current total local sales tax rate in Franklin County OH is 7500.

Franklin Countys is 75. The current sales tax on car sales in Ohio is 575. There are also county taxes that can be as high as 2.

The Ohio sales tax rate is currently. Ohios state sales tax rate can change depending on the type of purchase you make as listed by Sales Tax States. The December 2020 total local sales tax rate was also 7500.

Its important to note this does not include any local or county sales tax which can go up to 225 for a total sales tax rate of 8. If you need access to a database of all Ohio local sales tax rates visit. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

Taxes are due on a vehicle even when the vehicle is not in use. 1500 title fee plus sales tax on purchase price add 100 fee per notarization andor 150 for out-of- state transfers. Bring in your out of state title inspection.

The minimum combined 2022 sales tax rate for Franklin Ohio is. The inspection forms are valid for 30 days from date of inspection. Overview of the Sale.

The lowest rate you can pay on your sales tax is 58.

Vehicle Importing Overview Franklin County Clerk Of Courts

Ohio Form 2290 Heavy Highway Vehicle Use Tax Return

23 Pre Owned Cars For Sale In Columbus Mercedes Benz Of Easton

Miami County Gives 4 Raises With Budget Solid Sales Tax Revenue Up

Ohio Sales Tax Guide For Businesses

Ohio Sales Tax Small Business Guide Truic

Franklin County Raising Plate Fees

Ohio Car Registration Everything You Need To Know

Sales Taxes In The United States Wikipedia

Willard Ohio 1977 Postcard Library Downtown Ben Franklin Store Huron County Ebay

Lo 23 2 Research 31 Cuyahoga County Ohio Has A Chegg Com

23 Pre Owned Cars For Sale In Columbus Mercedes Benz Of Easton

Lower Taxes On Car Purchases In Effect In Georgia Georgia Thecentersquare Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/HTLBYQFUDFFP3CROIV7NJG76CY.png)

Finishing Touches Put On The Franklin County Courthouse

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Franklin County Ohio Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Vehicle Taxes Department Of Taxation

Pennsylvania 2022 Sales Tax Calculator Rate Lookup Tool Avalara